2d Investment Problem

To examplify a discounted problem we consider a 2d variant of an investment problem, originally introduced in [HKHF03] and furhter explored in [GruneSS15].

The system dynamics for this problem are given by

where we set \(\sigma = 0.25\) for our calculations.

To implement the dynamics we have to initialize a function that implements the right hand side of the dynamics.

sigma = 0.25

def f(x,u):

y = nmpyc.array(2)

y[0] = x[1]-sigma *x[0]

y[1] = u

return y

After that, the nMPyC system object can be set by calling

system = nmpyc.system(f, 2, 1, 'continuous', sampling_rate=0.2, method='heun')

To model the payoff of the investment problem we assume th stage cost

where \(R(x_1) = k_1 \sqrt{x_1} - x_1/(1+k_2 x_1^4)\) is a revenue function of the firm with a convex segment due to increasing returns. \(c(x_2) = c_1 x_2 + c_2 x_2^2/2\) denotes adjustment costs of investment and \(v(u) = \alpha u^2/2\) represents adjustment costs of the change of investment. The convex segment in the payoff function just mentioned is likely to generate two domains of attraction. Additionally we choose \(k_1=2\), \(k_2=0.0117\), \(c_1=0.75\), \(c_2=2.5\) and \(\alpha=12\) for our computations.

With the nMPyC package the implemnetiation of the objective corresponding to this costs can be done as follws.

def l(x,u):

R = k1*x[0]**(1/2)-x[0]/(1+k2*x[0]**4)

c = c1*x[1]+(c2*x[1]**2)/2

v = (alpha*u[0]**2)/2

return -(R - c - v)

objective = nmpyc.objective(l)

Since this problem is unconstrained we can now initialize our model by

model = nmpyc.model(objective,system)

For our simulation we assume set the discount factor to

where \(h=0.2\) is our samplimng rate and \(\delta=0.04\) is the continuous discount rate.

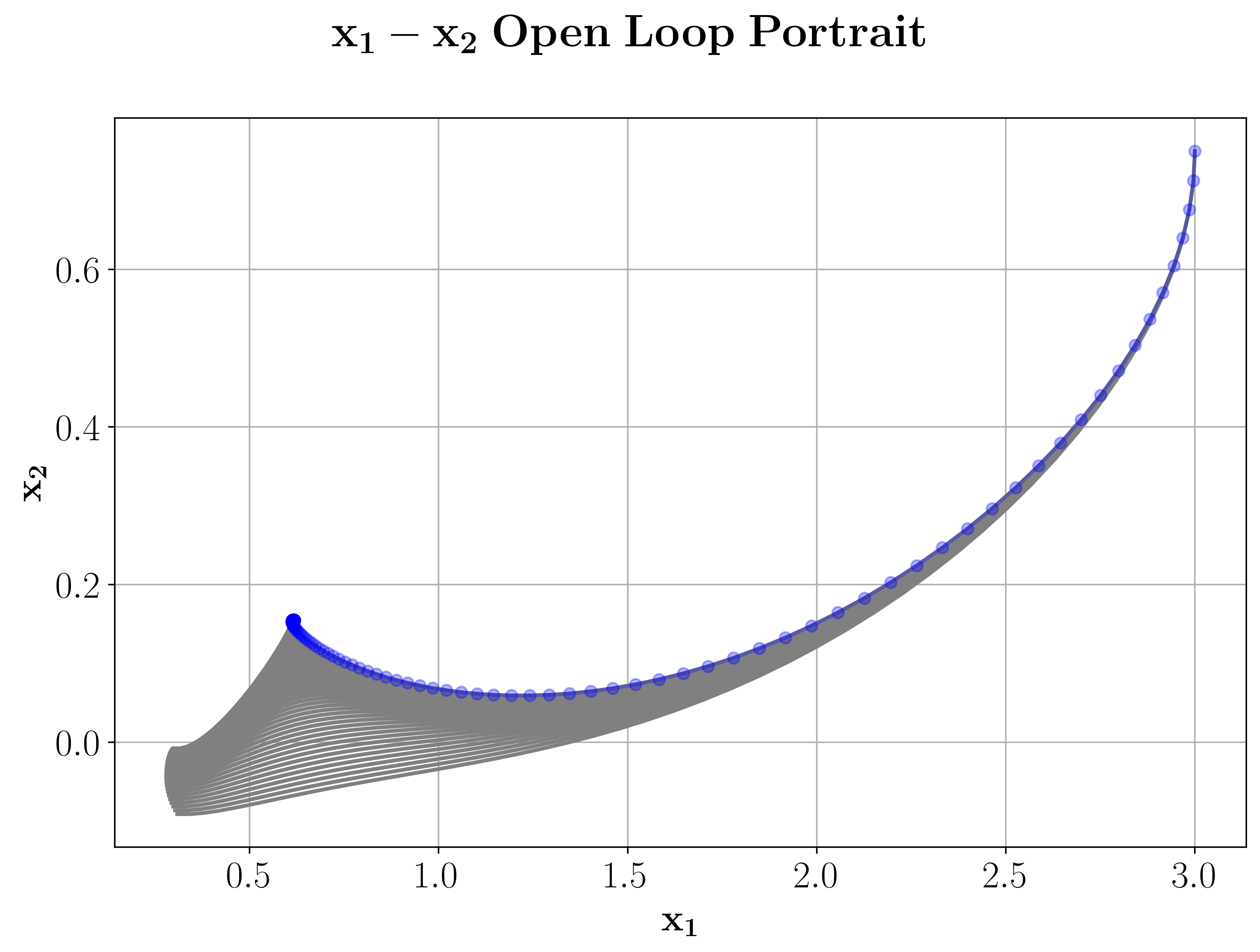

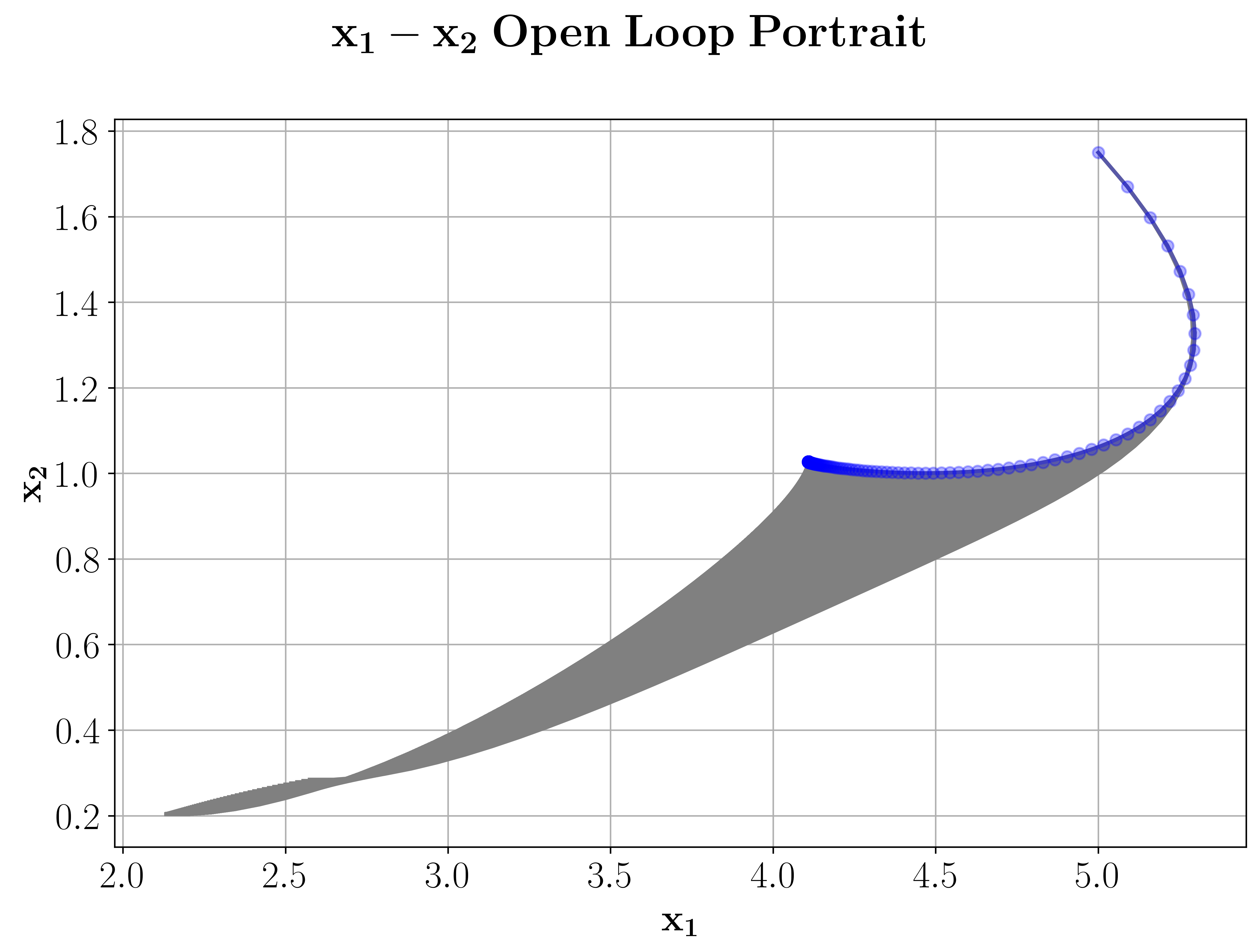

It can now be shown that this problem has two domains of attraction, one at roughly \(x^* = (0.5, 0.2)\) and the other roughly at \(x^* = (4.2, 1.1)\). Now we choose ifferent initial values from both domains of attraction to test, if we can replicate the two domains of attraction for a finite decision horizon by using nonlinear model predictive control. For this purpose we set the MPC horizon \(N=50\) and the number of MPC iterations to \(K=500\).

This leads to the following code for running the closed loop simulation for the discounted problem.

discount = nmpyc.exp(-0.04*0.2)

N = 50

K = 500

x0 = nmpyc.array([3.0,0.75])

res1 = nmpyc.mpc(x0,N,K,discount)

x0 = nmpyc.array([5.0,1.75])

res2 = nmpyc.mpc(x0,N,K,discount)

Looking at the phase portraits of the two simulations, we can confirm that we really converge against the two different equilibria with the closed loop trajectory. The phase portraits of our simulations can be plotted with the nMPyC package by calling

res1.plot('phase', phase1='x_1', phase2='x_2', show_ol=True)

res2.plot('phase', phase1='x_1', phase2='x_2', show_ol=True)

The option show_ol=True will also plot the pahase portraits of the open loop simulations of each iteration, which leads the output below.